Published on Tuesday, August 2, 2011 by Too Much

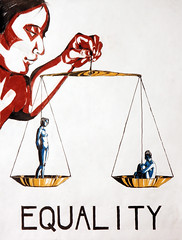

Against a Congress where zealously rich people-friendly conservatives hold the upper hand, how much can a President of the United States committed to greater equality realistically hope to accomplish?Doing Debt Ceiling Battle the FDR Way

At times of fiscal crisis, President Franklin Roosevelt believed, you don’t give the awesomely affluent a free pass. You pound them — and then you pound some more.

The answer from today’s White House: not much. Advocacy for equality has to take a backseat, Obama administration insiders insist, once fanatical friends of the fortunate in Congress recklessly put at risk our nation’s full faith and credit.

But history offers another alternative. Back in 1943, halfway through World War II, a President of the United States confronted a debt ceiling crisis eerily similar to our own. That President, Franklin Roosevelt, faced a congressional opposition to inconveniencing the rich — with higher taxes — every bit as rabid as ours.

FDR’s choice, in the face of this opposition? He doubled down on equality.

Roosevelt’s debt ceiling battle actually began in the months right after Pearl Harbor. The nation needed dollars — and lots of them — to wage and win the new war. FDR wanted those dollars raised as equitably as possible.

That would require, FDR and his New Dealers believed, a steeply graduated income tax, with tax rates on income in the top income brackets much higher than rates on income in the bottom brackets.

How high should the top rates go? All the way, FDR proposed, to 100 percent. At a time of “grave national danger,” the President told Congress in April 1942, “no American citizen ought to have a net income, after he has paid his taxes, of more than $25,000 a year,” an income just shy of $350,000 in today’s dollars.

The year before, gun executive Carl Swebilius had pulled in $243,204 after taxes, the equivalent of over $3.7 million today. Steel exec Eugene Grace had grabbed $522,537, over $8 million today, in 1941 salary. But conservatives in Congress looked the other way. They never gave FDR’s plan any love.

Four months later, Roosevelt would try again. In his Labor Day message, FDR repeated his $25,000 “supertax” income cap call. Again Congress ignored him.

FDR would not back down. In early October, the President flexed his authority under the newly enacted Emergency Price Control Act and issued an executive order that limited top corporate salaries to $25,000 after taxes, a move, he pronounced, needed “to correct gross inequities and to provide for greater equality in contributing to the war effort.”

America’s wealthiest, New Dealers explained afterwards to the press, “should be willing to get along on more than $2,000 a month while marines endure tortures on Guadalcanal Island for $60 a month and room and board.”

FDR’s executive order would infuriate conservatives. They saw red, literally. The “only logical stopping place for this movement,” fumed Princeton economist Harley Lutz, would be “a completely communistic equalization of incomes.” FDR’s salary cap, roared New Bedford publisher Basil Brewer, just might “lose the war.”

In Congress, meanwhile, lawmakers vowed to kill FDR’s executive order by any legislative means necessary. Roosevelt, in response, simply kept pushing. In January 1943, he reminded Congress that “the receipt of very large net incomes from any source constitutes a gross inequity undermining national unity” and asked lawmakers to make taxes on America’s highest incomes “fully effective.”

Roosevelt also asked Congress, in his 1943 budget message, to raise the nation’s debt ceiling. Conservatives indicated they would — if the ceiling bill included a rider that repealed the President’s $25,000 salary cap executive order.

Lawmakers would not go along with a debt ceiling hike, California Republican Bertrand Gearhart told reporters, until FDR’s “thoroughly un-American” salary cap, “fraught with such disaster to the Republic, is wiped from the books.”

At this point, no “realistic” observer could have faulted FDR if he simply threw in the towel. The 1942 mid-term elections the previous November, after all, had significantly strengthened the congressional conservative camp, in large part because millions of New Deal voters — soldiers overseas and workers who had migrated far from home for wartime factory work — couldn’t vote.

But FDR threw in nothing. To reporters and Congress, he reiterated his support for the $25,000 salary cap. Of course, the President added, he would “rescind” his cap in an instant if Congress passed legislation that limited all individual after-tax income, not just salary, to $25,000.

And if Congress couldn’t see fit to go that far, the President helpfully suggested, he hoped lawmakers would enact “steeply graduated rates” that brought taxes on top-bracket income up to the 90 percent neighborhood.

Eventually, both the House and Senate would pass the debt ceiling bill — with the salary cap repeal rider attached. Most Democrats went along, noting, as Senator Alben Barkley put it, “the importance of increasing the debt limit.”

Roosevelt well understood that importance, too. He would let the higher debt ceiling bill become law, without his signature. But FDR quickly signaled no surrender in his continuing battle to make sure that “not a single war millionaire will be created in this country as a result of the war disaster.”

Congress, Roosevelt pointed out, “had authorized the drafting of men into the armed forces at $600 a year regardless of what they had earned in civilian life,” but, with the salary cap repeal, had “refused to reduce the salary of a man not drafted no matter how high his income might be.”

The President, to be sure, had definitely lost the debt ceiling battle over his executive salary cap, as he no doubt knew he would. But sometimes a President can win by “losing.” FDR did not prevail on the salary cap. He did prevail in his far broader struggle to shape the wartime finance debate.

Roosevelt’s relentless campaign to cap top incomes kept that debate focused on taxing the rich. Conservatives didn’t want to do that taxing. They wanted a national sales tax instead, as do many conservatives today. But FDR’s aggressive advocacy for equity never let that regressive sales tax notion get traction.

The war revenue debate would be fought on Roosevelt’s terms — not on whether to tax the rich, but on how much. And, in the end, that “how much” would turn out to be quite a great deal. By the war’s end, America’s wealthy would be paying taxes on income over $200,000 at a 94 percent statutory rate.

Americans making over $250,000 in 1944 — over $3.2 million today — paid 69 percent of their total incomes in federal income tax, after exploiting every tax loophole they could find. In 2007, by contrast, America’s 400 highest earners paid just 18.1 percent of their total incomes, after loopholes, in federal tax.

None of the debt ceiling “deals” that House and Senate leaders advanced last week asked any of these top 400 — or any other rich Americans — to pay a penny more in taxes than they do now. In the 2011 debt ceiling struggle, inequality has clearly triumphed.

So what ought we learn, amid this triumph for greed, from FDR’s debt ceiling battle? Maybe this: We really can have a more equal America. We just need to fight for it.

No comments:

Post a Comment